For the TMC, being able to provide a mobile travel app with auto-itinerary updates, flight status and all the relevant information their travellers might need has moved from an aggressive differentiation strategy of a few years ago to an increasingly must have service strategy today.

After accepting the fact that they need to offer something a question I get asked all the time is - "How can we make money from this?"

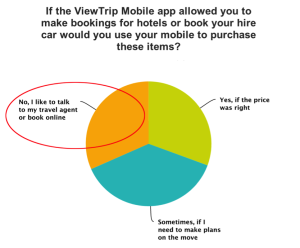

We thought we'd ask real travellers who had recently used a mobile travel app to help manage their trip, if, when and how they would want to purchase additional travel products beyond the point of sale.

Mantic Point operates the Travelport ViewTrip Mobile service available free to Travelport's agencies and tightly integrated with the online viewtip.com service. In December 2013 we decided to ask over 4,000 of the viewtrip mobile subscribers what was most important to them about the service as well as mobile travel apps in general and how they prefer to purchase.

Along with this survey,

Tnooz recently published a couple of articles that really reinforce how the TMC is leaving money on the table by not making it relevant and easy for the traveller to purchase both tradition travel items and a broad range of other travel revenues.

The first of these, reports survey results for how click to call (C2C) is becoming increasingly important in the travel sector. Good news for TMC's who've made investments in the consultant led experience. Tnooz reported that 32% of 1,500 traveler surveyed said they regularly used C2C to research services.

In our traveller survey we saw a significant increase in business travellers who want easy access to their travel consultant to make changes or additions to their itineraries. In 2012, when we first ran the survey, 71% of respondents wanted to be able to make those changes themselves online or via mobile. Just a year on this response has dropped to 62%, meaning 38% of travellers who want to talk to a real person to help them with their journey up from 29% just 12 months earlier.

We'll repeat our survey again again towards the end of 2014 and in subsequent years to build up a really detailed picture of travellers preferences and how they change over time.

The second Tnooz article builds on a report from the Harvard Business Review - Know what your customers want before they do - both reinforce our own survey findings about the rise of NBO - Next Best Offer

As Mantic Point focuses on post-booking merchandising, the definition used here for NBO's exclude point of sale up-selling, lots of travel firms already have successful strategies to maximise the value of the initial sale transaction. Our aim is to use itinerary, profile and contextual data to drive relevance into the post booking communication strategy that can drive incremental revenue.

Our algorithms describe the traveller persona based on the TMC's client base. Including client profile information, trip stage, appropriate delivery channel and the TMC's "traveller communication strategy" that correlates to which content needs to be served, by what channel and at what time.

Lets work through a real example. One segment type that is often not taken at point of sale is airport parking. The purchasing behaviour if often to leave this to later in the trip planning as the individual concentrates on booking the right trip, that fits with policy or business needs.

Airport operators and parking consolidators know this. One of our past airport operator clients once shared their "business traveller journey" strategy with us. Their key selling moment focused on the 3 to 5 day window prior to departure as this gave them the best conversion rate for new business. What airport operators and the like don't have is access to the itinerary to work out when are the best selling opportunities.

We worked with them on various ways of enticing the passenger to share their itinerary (in return for flight status tracking). We achieved a 4% conversion rate from mobile itineraries that didn't have a parking segment in them. Even at a basic affiliate level, this is new money to the agency, it doesn't cannibalise the consultant led selling experience and builds the traveller purchasing profile. Money currently left on the table.

Imagine this same approach extended to hotel attachment rate across the traveller community (something we're doing with one of our large TMC's - more in a later post).

Finally there are our results and behaviours from non-traditional merchandising revenue channels we operate. TMC's want to help manage clients costs. One of the ways we help is in reducing the costs their clients employees incur during travel - and make money for the TMC in the process.

We work with airport retailers to make targeted offers to passengers - mostly for airlines. Typically the offers are their to promote footfall into the retail concessions to get them spending money. We re-use this technology to send discount vouchers to travellers for commonly purchased items that fits the traveller and client profile - meaning lower expense claims. At the same time the airport retailers will pay for the privilege to offering the clients employees a way to spend less.

Our voucher delivery rates, charged to the airport retailer are £0.20 per voucher. For those of you who are familiar with mobile ad rates you'll know this is a stellar rate. Why? Retailers will pay handsomely for blind access to premium profiles of people who are travelling through their airport. Again, new money not on the table for TMC's but waiting to be placed in their hands.

The conclusion must be that a holistic approach to post-booking itinerary management across multiple channels, sensitive to trip stage and profile can significantly alter the revenue performance of each booking.

Drop me a note if you'd like to know more about how Mantic Point make this happen.