TMC travel risk management pricing strategy

Posted by Mike Atherton on 16 April, 2015

Travel Management Companies have a difficult dilemma to resolve when offering commercial travel risk management products to their clients. Whilst there are many providers on the market from simple news aggregators to analyst led intel teams the same question comes back again and again – “how can I afford to provide risk content and can I make money from it?”

TMCs operate on famously thin margins, even with clever service and organizational models it can be hard to win clients with an acceptable margin. As more and more travel purchasing decisions are led by procurement, adding in more content cost without any uplift in fees or new commission opportunities looks unsustainable.

That said the trend for clients to push their TMCs to provide a duty of care or risk management service is undeniable, most TMCs I come across say its increasingly moving from a nice to have to a mandatory service requirement in most RFPs. The challenges the TMC faces include:

- Not all their clients’ need, want or are willing to pay for a full blown risk management solution.

- Most account managers are focused on the travel buyer not the risk manager – so miss out on important insights into what their clients want.

- New business managers are often not well versed in risk management and so again cannot drive the value through the deal.

- The traditional referral approach with the established risk providers means there’s little incentive to invest in the skills needed and no opportunity to differentiate the service experience when every other TMC is offering the same referral deal.

Let's have a deeper look into these challenges. Like most businesses TMCs have a spread of client types and sizes with fewer larger clients and many more long tail medium to small clients. Within this client population they’ll be an equally diverse set of requirements to managing employee risk, everything from an unsophisticated “not my problem” to those needing customized, closely managed repatriation and medical services.

From a functionality perspective not all clients have a defined view of what risk management means for them. I had an agency recently that after a long consultation period with its client base came to the conclusion that for their clients, travel risk management meant just flight disruption alerts.

So a one size fits all strategy, which often means hitting the lowest common denominator in terms of quality of content and functionality, is unlikely to serve the agency’s needs or their clients.

Travel management companies manage travel, so the likelihood of new business and account management teams really understanding risk management is going to be low – otherwise they wouldn’t be a TMC they’d be a risk management company. The more successful agencies are those that have an evolving, incremental approach to providing an integrated risk management strategy for their clients. An excellent example of this is the FCm Secure service that provides a valuable risk service to all its clients with customization options to delivers an exact fit for different clients needs (disclosure: Mantic Point provides the technology that powers the FCm Secure service). Another great example is Portman Travel’s Traveller Tracking service (disclosure: we power this too).

Both these agencies offer their clients a step by step approach to risk management, enabling them to match their employee protection needs with their wider business objectives.

So the real challenge is to decide what to offer and when (content) as well as how its gets delivered and to whom (technology) Rebadging the major risk management companies content and technology doesn’t really work in terms of client needs and budget. Most of the time they’re too heavy functionally and expensive financially. As an aside, why should this be? Risk management companies are mostly focused on their own corporate direct channels and see TMCs as somewhere they can get referrals from whilst managing any potential cannibalization of their direct channel. Which means they don’t develop products and services that are TMC friendly.

So coming back to the first part of the original question – how can I afford to provide risk products? The first step is to match the right content to the right client profile, which can drive affordability. Whilst clients will always want the best for their travelling employees it’s often a fact that their budget doesn’t meet what they can afford – one corporate client recently described their situation as “wanting champagne but having only beer money” – well they’re still looking for a solution. The reality is real risk intelligence is an expensive, resource intensive and skilled business.

Travel news aggregation services such as intelliguide promote themselves as a lower cost travel alert provider – they even compare themselves as a low cost alternative to iJET a leading intel led travel risk management provider (and Mantic Point strategic partner) The intelliguide approach is totally different to iJET but does provide low budget clients with an alternative. Other clients will be happily served by rehashing PNR data on a map as a minimum so they know where their employees are (or should be) Travelport’s Journey Reporter is an example used my many agencies, although probably better described as duty of care reporting tool rather than risk management.

So to the second part of the original question – “can I make money from risk management?”

On the face of it there are three different commercial options:

- Provide it free as part of the wider service offering, bundling in content to cover the widest possible audience.

- Charge a fee either by client or by PNR

- Use a freemium pricing model to entice clients to upgrade to paid services

The first option runs up against the affordability barrier but provides a real service differentiation to clients. Each agency has its own ROI processes but matching content source to the right delivery technology can make it work, but its always difficult to measure new business or account retention success. The strategic advantage of this approach is likely to reduce over time as more and more agencies provide a minimum viable travel risk service and as clients appreciate the difference between news aggregation and risk intelligence, but those that move first will be able to identify and build the necessary client relationships to move the service to a paid model.

Charging means the number of clients willing to adopt will drop dramatically, especially if the client needs a full travel risk management service rather than a news editorial service. Most agencies will have a very small number of these given their average client profile. This is where working with an established risk management player is essential as the travel management company will be trading off the risk providers brand, expertise and marketing. Traditionally these relationships are either a referral (you win the client and then pass them over to the risk provider) or reseller (you contract with the client, usually with a commitment to the risk provider) Unfortunately even though the individual client might spend six figures on a risk service, referral agreements are in the region of 5 to 10% of first year values and reseller agreements aren’t much better. Hence the difficulty for TMC’s to invest in skills and marketing.

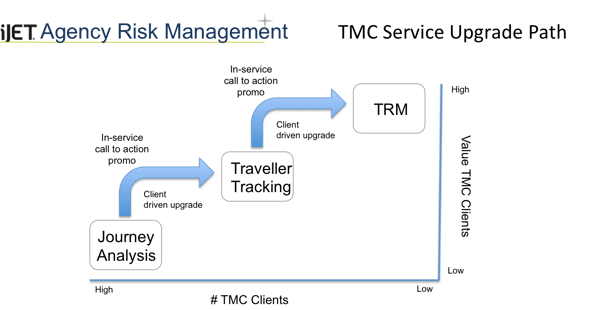

So this comes to what we think is the most effective way to balance the two approaches of affordability and incremental revenue. Offering an entry level experience for all clients that they can upgrade as and when they need with an intuitive and consistent user experience that seamlessly moves them from the basic service offerings to the full travel risk management service.

This approach uses Mantic Point’s technology to help guide the client though an evolution of service to make sure they have the best fit for their business but without the need for the TMC to invest in one approach or the other. When the client experiences the service as part of an integrated approach to TMC service management it build loyalty and makes it harder to compare one TMC with another.